Coming May 2025

Get Early Access

Research Startups

World Class Venture Research

aVenture brings public market-quality research to private markets. Get free access for longer by creating an account today.

Latest Company News

Fundraising Rounds

The Shape Sensing Company

Austin, US

Raised

Round

Series B

Investors

—

VectorShift

San Francisco, CA, US

Raised

$3M

Round

Seed

Investors

5

Simetrik

Bogota, CO

Raised

$55M

Round

Series B

Investors

8

Arini

San Francisco, CA, US

Raised

$500k

Round

Pre Seed

Investors

1

Authologic

Warsaw, MZ, PL

Raised

Round

Non Equity Assistance

Investors

1

Flower

Hamburg, HH, DE

Raised

$20M

Round

Series A

Investors

9

Armilla AI

Toronto, ON, CA

Raised

$4.5M

Round

Seed

Investors

7

Recent Research Reports

VC and Private Fund News

Risk and return across different asset classes

Source: Morgan Stanley (2020), “Public to Private Equity in the United States: A Long-Term Look”. Past performance does not ensure future results and expected risk, returns, or other projections may not reflect future performance. All asset classes correspond to the period 1984-2015, except for venture capital funds, which reflect the period 1984-2013, representing the most recent data available at the time of the study publication.

Venture Has Had Better Risk-Adjusted Returns

Since 1984, venture funds have exhibited comparable risk to some public and private equity investments, while potentially offering better returns.

High Growth Companies Are Often VC Investments

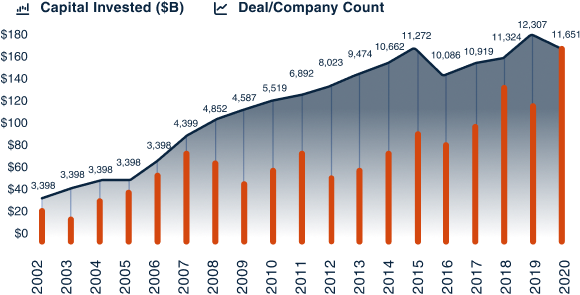

Since 2006, the number of deals and the capital raised have been growing exponentially, reaching a total of $164 billion invested across 11,651 deals in 2020 alone.

Venture capital investments over time

Source: NVCA, 2021. “NVCA 2021 Yearbook”, with underlying data provided by Pitchbook. Analysis period 2002-2020. The chart as displayed includes the total capital raised for each year in the VC asset class and the number of investments made by VC funds.

Early Access Coming May 2025

aVenture is in Alpha: aVenture recently launched early public access to our research product. It's intended to illustrate capabilities and gather feedback from users. While in Alpha, you should expect the research data to be limited and may not yet meet our exacting standards. We've made the decision to temporarily present this information to showcase the product's potential, but you should not yet rely upon it for your investment decisions.

aVenture is in Alpha: aVenture recently launched early public access to our research product. It's intended to illustrate capabilities and gather feedback from users. While in Alpha, you should expect the research data to be limited and may not yet meet our exacting standards. We've made the decision to temporarily present this information to showcase the product's potential, but you should not yet rely upon it for your investment decisions.

© aVenture Investment Company, 2025. All rights reserved.

44 Tehama St, San Francisco, CA 94105

aVenture Investment Company ("aVenture") is an independent venture capital research platform providing detailed analysis and data on startups, venture capital investments, and key industry individuals.

While we strive to provide valuable insights with objectivity and professional diligence, we cannot guarantee the accuracy of the information provided on our platform. Before making any investment decisions, you should verify the accuracy of all pertinent details for your decision.

aVenture does not offer investment advisory services and is not registered as an investment adviser. The data provided by aVenture does not constitute recommendations or advice, whether by methodology or a statement written by a staff member of aVenture.

Links to external websites do not imply endorsement or affiliation with aVenture. References or links to providers offering the ability to invest in a primary or secondary transaction in a company are for convenience purposes only. They are not solicitations or offers to buy or sell an investment. Remember that past performance does not guarantee future results, and venture capital and private assets should be a contributory part of a diversified portfolio.